Since launching Bank Strategy Briefing in January 2017, we have gone on record annually with our predictions on bank M&A activity, and our predictions have largely held true (so far!). Our most recent assertion that M&A activity in our region will remain elevated and perhaps accelerate further in 2019 is no exception, and our attorneys witnessed this trend first hand. According to rankings maintained by S&P Global Marketing Intelligence, Godfrey & Kahn served as lead counsel on seven M&A transactions announced during the first half of 2019, which is the third highest total for law firms nationally.

In our home state of Wisconsin, 14 whole-bank transactions have already been announced through June 30. This almost certainly foreshadows the most active M&A year in Wisconsin since at least 1992, breaking the mark of 17 set in 2016 and 1996, and is especially noteworthy given only 201 Wisconsin-based charters remained as of the start of the year (as compared to 243 and 439 as of January 1, 2016, and 1996, respectively).

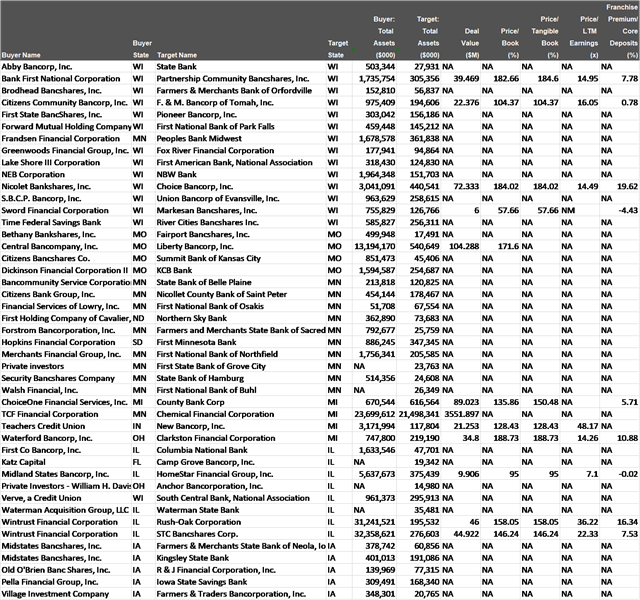

Through June 30, 2019, there were 45 whole bank deal announcements in our focus states of Wisconsin, Iowa, Illinois, Minnesota, Michigan, and Missouri. On an annualized basis, this equates to 90 deal announcements as compared to 74 in 2018, a 22% increase. There is little doubt that we continue to be at a peak in the M&A cycle. Attached to the end of this Bank Strategy Briefing is a list of all whole-bank deals announced through June 30, 2019, in our focus states.1

We also predicted at the beginning of 2019 that there would be more opportunities for privately-held buyers, with publicly-traded bank holding companies retooling their M&A strategies in the wake of lower stock prices in late 2018 and early 2019. This prediction also appears to be supported by the data. In 2018, the buyer in approximately 38% of all announced deals in our focus states was a public or quasi-public company,2 and that percentage has dropped to approximately 24% in the first half of 2019.

So, what do we expect the second half of 2019 to look like? Probably much like the first half as potential sellers weigh locking in a sale premium for shareholders now against the prospects of a looming recession.

However, if we had to give boards and executive management teams a single take-away message relating to M&A activity to focus on for the remainder of 2019 it would be this: plan with purpose and proceed with care. It is looking more likely that the economic environment in which M&A decisions are being made could shift in the next year or two, which will no doubt have an impact on deal activity for buyers and sellers. More than ever, we urge boards and management teams to actively and regularly discuss M&A strategies—whether it is to buy, sell, or remain independent—to ensure that these strategies continue to be relevant as conditions in the economy and M&A market change.

1 Data Source: S&P Global Market Intelligence. Data reflects whole-bank transactions announced from 1/1/19 through 6/30/19 where the seller was headquartered in WI, IA, IL, MN, MI, or MO.

2 Measured as any bank holding company with a ticker symbol.