In our February edition of Bank Strategy Briefing, we highlighted a developing trend: accelerating loan-to-deposit ratios in Wisconsin, Iowa, Illinois, Minnesota,and Missouri. We also predicted that the resulting need for core deposit funding at an increasing number of community banks would begin driving more (and more expensive) branch and whole bank transactions in the near future.

One additional theme that has become more apparent is that banks with the greatest need for deposits tend to be located in metropolitan markets, while banks that are flush with deposits tend to be located in rural markets. An unsurprising observation, no doubt. One can predict that these market forces should drive "metro" banks to pursue and pay up for banks and branches in contiguous rural markets, and, in fact, this is already happening.

According to a recent article published by SNL Financial, from 2012 to 2015 banks located in areas with an urban core of less than 50,000 in population (i.e. non-metro banks) constituted 16.6% of all acquisitions by banks located in areas with an urban core of greater than 50,000 (i.e. metro banks). In 2016 and 2017 acquisitions of non-metro banks by metro banks increased to 20.9% and 19.5%, respectively, of all such acquisitions.

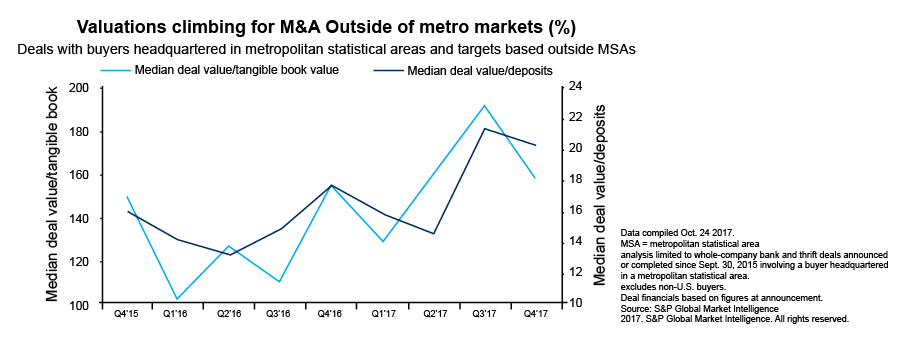

Pricing data shows that this increased acquisition interest in non-metro banks appears to be positively correlated with an increase in purchase premiums for these banks, as measured based on both tangible book and deposit multiples.

Competition for core deposit funding is likely to intensify. For those community banks with an existing need for core deposits, in addition to employing marketing strategies to attract new deposits and securing secondary funding sources, management teams and boards may wish to consider whole-bank or branch acquisition opportunities in local and contiguous markets. As interest rates continue to rise, acquirers motivated by funding needs will likely be able to justify increasingly attractive premiums, which in turn should attract a new round of sellers.

For those community banks flush with liquidity, management teams and boards may wish to remain opportunistic and consider a branch or whole bank sale if presented with an attractive premium. In particular, this may be a good time to analyze branch footprints to determine if a divestiture of a branch location makes sense. For the right institution, the premium earned and efficiencies gained from such a divestiture may generate significant value for shareholders.

In addition, the developing need for deposits at some banks may result in an increase in unsolicited offers to acquire deposit-rich banks. Directors should always be cognizant of their fiduciary obligations in the event they are approached on an unsolicited basis. A good rule of thumb is to promptly contact your legal counsel any time you are approached about a potential strategic transaction.

Our Financial Institutions Practice Group at Godfrey & Kahn is closely following core deposit funding trends, and we stand ready to assist boards and management teams considering their strategic options with respect to these matters.