Have you studied your shareholder list lately? It can tell you a lot of things and should be one of the tools your board and management team uses to strategize for the future, particularly if your shares are widely and privately held. One issue to focus on is your bank’s percentage of non-local shareholders.

Have you studied your shareholder list lately? It can tell you a lot of things and should be one of the tools your board and management team uses to strategize for the future, particularly if your shares are widely and privately held. One issue to focus on is your bank’s percentage of non-local shareholders.

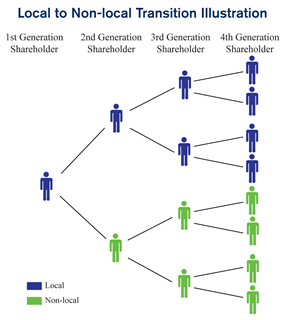

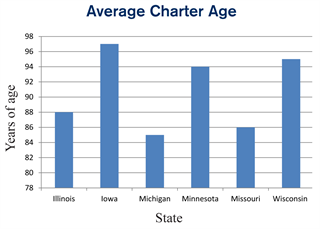

Many community bank charters in the Midwest are quite old, and as a result shares have been handed down from generation to generation multiple times. Over time, your shareholder base grows, individual shareholders hold fewer and fewer shares, and more and more of your shareholders live in places other than your bank’s community.

These non-local shareholders often share similar characteristics:

- Lack of Attachment. They may lack an attachment to the community and likely do not feel the pride of owning local community bank stock that their parents, grandparents, or great-grandparents felt.

- Modest Holdings. Because of the small number of shares that they each individually own, dividend income is relatively modest.

- Passive. They are passive, electing to quietly accept dividend checks and (maybe) return a proxy card every year for the annual shareholder meeting.

So why should your bank care about non-local shareholders? In our experience, because of their characteristics outlined above, they tend to be more interested in a liquidity event than local shareholders when given the opportunity. In fact, we have seen an instance where one factor in a board’s decision to sell its bank after an unsolicited offer was the fact that over 70% of its shareholders no longer lived in or near its community. When given the opportunity to vote on a sale, the non-local shareholders overwhelmingly approved it. They were far more interested in a lump sum payment than a modest dividend stream from a bank they did not know much about.

If you are a community bank with a lot of non-local shareholders, and you think remaining independent is in the best interest of the majority of your shareholders, consider how to address non-local shareholders’ needs. Share repurchase programs, tender offers and squeeze-out transactions are potential ways to decrease non-local ownership while providing liquidity and fair value for any shares repurchased or squeezed-out. Another option is to “re-mix” your shareholder base by raising additional capital from local individuals, either by itself or in connection with one of the other aforementioned strategies.

On the other hand, if your bank is interested in acquiring another bank, you might consider looking for a community bank that is widely held with a “mature” shareholder base. Such a community bank may have a lot of non-local shareholders who prefer a liquidity event.

Regardless of your bank’s specific strategic plans, take some time at your next strategic planning session to study your shareholder list to determine what, if anything, it tells you about how to best deliver value to your shareholders.