Bank Strategy Briefing: M&A book value multiples

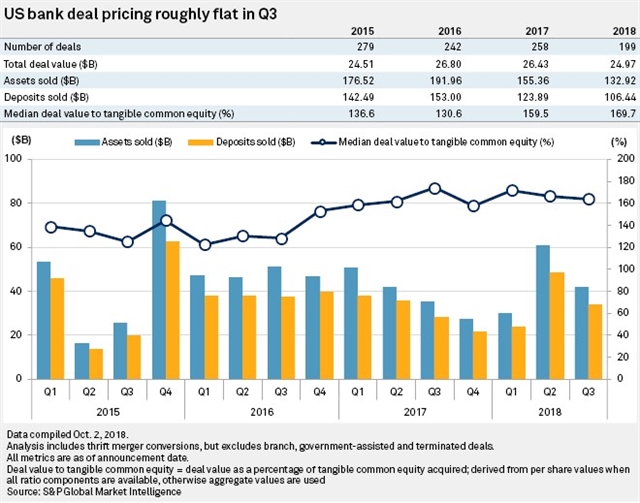

One common question we get from community bankers is: What are banks selling for these days? Most of the time the person asking the question is looking for some multiple of tangible book value. This “Price/TBV” multiple is a seemingly simple metric that many in the industry use to identify pricing trends on a macro-level. Here are the current trends on this data:

There is a tendency in the industry for some institutions to casually use Price/TBV multiples as a benchmark to gauge whether a particular seller received an attractive premium or whether a particular buyer struck a good deal on an acquisition. The problem is that Price/TBV data can be a misleading metric. This is because reported Price/TBV multiples are often applied in a non-uniform manner based on deal structure and the amount of tangible equity on a particular seller’s balance sheet. Those relying on Price/TBV as an apples-to-apples comparison of deal valuations run the risk of being misled by these nuances. This can lead to unrealistic expectations when exploring M&A opportunities on both the buy-and sell-side.

To illustrate this point, consider the following (overly simplistic) illustrations of three identical banks that each sell for a 1.50x Price/TBV multiple, yet deliver significantly different purchase prices to their shareholders:

| Transaction #1 | Transaction #2 | Transaction #3 |

|---|---|---|

| Total Capital Example | Core Capital Example | Accrued Expense Example |

| Buyer pays 1.50x multiple on total tangible equity. | Buyer pays 1.50x multiple on 8% “core” tangible equity. Excess capital paid out on dollar-for-dollar basis. | Buyer pays 1.50x total tangible equity after seller accrues for core processor early termination and deconversion charges. |

| Total Assets: $100 million |

Total Assets: $100 million |

Total Assets: $100 million |

| Tangible Equity: $11 million |

Tangible Equity: $11 million |

Tangible Equity: $11 million |

| Accrual for $1.5 million core processor charges immediately prior to closing. | ||

| “Core” Equity: $8 million | Adjusted Tangible Equity: $9.5 million | |

| Multiple: 1.50x | Multiple: 1.50x | Multiple: 1.50x |

| Core Equity Price: $12 million | ||

| Add Excess Capital: $3 million |

||

| Purchase Price: $16.5 million |

Purchase Price: $15 million |

Purchase Price: $14.25 million |

Here are a few takeaways that we think are helpful:

- Deal valuations are nuanced and institution specific. Be skeptical of conclusions drawn based largely on reported or rumored Price/TBV multiples.

- There are many factors beyond Price/TBV that inform proper bank valuations including Price/earnings, comparable transactions, expected cost savings and earn-back period.

- Do not pursue or abandon an M&A strategy based on what you believe to be “market pricing”, unless you have done your homework.

- Speak with a good investment banker, attorney, accountant or other trusted advisor who can educate you on market-specific valuation information or connect you with the right expert.

Of course, our Financial Institutions team at Godfrey & Kahn, S.C. is always here to assist either directly or by connecting your bank with other helpful resources.