Bank Strategy Briefing: Do you have too much capital?

How much capital is too much capital? Your bank needs enough capital to support growth, absorb losses, and satisfy regulators; however, retaining too much capital can stifle shareholders’ return on equity and limit their ability to more efficiently invest their equity.

Your bank’s capital maintenance strategy should be specific to your bank’s situation. Some community banks have the luxury of holding a minimum amount of capital because they have ready access to additional capital should the need arise. Sources of capital for these banks tend to be the public markets (if the bank is a public company or poised to become one) or a wealthy ownership group and/or board.

Your bank’s capital maintenance strategy should be specific to your bank’s situation. Some community banks have the luxury of holding a minimum amount of capital because they have ready access to additional capital should the need arise. Sources of capital for these banks tend to be the public markets (if the bank is a public company or poised to become one) or a wealthy ownership group and/or board.

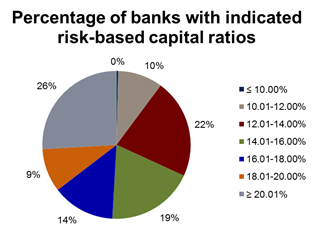

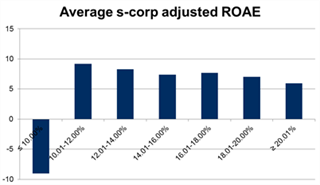

For other banks without such ready access to capital, there is a need to more conservatively retain capital. However, even for these banks, there is a point at which excess capital levels create a need by the board and management to consider ways to actively manage them. Consider the following breakdown of risk-based capital ratios1 and corresponding average ROEs at community banks in Illinois, Iowa, Michigan, Minnesota, Missouri, and Wisconsin:

The foregoing analysis indicates that some community banks may have significant amounts of excess capital and that—not surprisingly—ROE is being impacted as a result. We recommend that community bank boards analyze their capital position. If it is determined that a substantial amount of excess capital exists, the board should consider developing a plan to either deploy that capital into earning assets (via organic growth or acquisition) or, if appropriate, return some of it to shareholders.

The foregoing analysis indicates that some community banks may have significant amounts of excess capital and that—not surprisingly—ROE is being impacted as a result. We recommend that community bank boards analyze their capital position. If it is determined that a substantial amount of excess capital exists, the board should consider developing a plan to either deploy that capital into earning assets (via organic growth or acquisition) or, if appropriate, return some of it to shareholders.

If excess capital will not be deployed as part of a growth strategy, here are three methods by which your board can return excess capital to shareholders, along with some of the advantages and disadvantages of each:

| Strategy | Advantages | Disadvantages |

| Special Dividend |

|

|

| Tender Offer |

|

|

| Share Repurchase Plan |

|

|

If your community bank has excess capital, have a discussion at your next board meeting about what options may be available to provide the greatest value to your shareholders.

1 Numbers are as of March 31, 2017. Risk-based capital is used for illustrative purposes only, and banks need to monitor all regulatory capital ratios.