Bank Strategy Briefing: Loan-to-deposit trend - what is your bank going to do?

Bank Strategy Briefing: Loan-to-deposit trend - what is your bank going to do?

Authored By

Practices

A noteworthy trend is taking shape among a growing number of community banks in Wisconsin and our neighboring states: a need for deposit funding. Loan-to-deposit (LTD) ratios are surging for many institutions, in part due to increasing loan demand. Boards and management teams who understand this trend will be better prepared to pursue strategies to (i) address deposit shortfalls or (ii) capitalize on deposit surpluses. This edition of Bank Strategy Briefing provides data to highlight the trend and then discusses the strategic options your bank may want to consider.

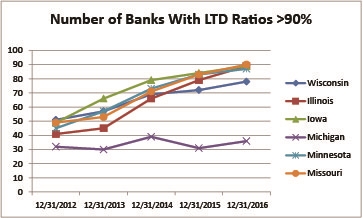

The graph below illustrates the number of banks located in Wisconsin and other selected states with LTD ratios in excess of 90%. With the exception of Michigan, the number of banks with escalated LTD ratios has increased steadily and dramatically over the last five years. Note that Wisconsin, Illinois, Iowa, Minnesota and Missouri each have more than 75 banks with LTD ratios in excess of 90%, and many of these banks’ ratios (155 of them) exceed 100%. What’s more impressive is that the number of banks with LTD ratios greater than 90% has nearly doubled in five of the six states over the last five years (again, with the exception of Michigan).

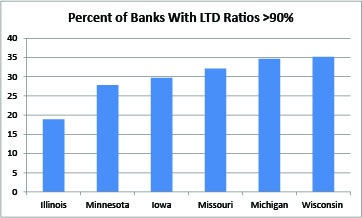

The graph below shows the relative number of banks in each state with LTD ratios greater than 90% as of Dec. 31, 2016. With the exception of Illinois, roughly 25-35% of banks in these states now have LTD ratios greater than 90%. Wisconsin is leading the way with 35% of its banks exceeding this threshold.

So what are the takeaways for your management team and board of directors?

- Understand the Trend. If this trend continues, deposits will become increasingly valuable, and banks in need of deposits will need to either “pay up” to attract deposits in the marketplace, rely more heavily on non-core funding sources, or seek to acquire deposits through either a branch or whole bank acquisition. On the other hand, banks with excess deposits will have an increasingly valuable “asset.”

- Analyze Your Position. Consider conducting an ongoing review of the LTD trends at your bank and at your competitors’ banks so that you can detect risks and opportunities early.

- Follow the Market. Understand the market for purchases and sales of deposit portfolios. The need for deposits may drive more branch sales and mergers in the near future, and competition for strategic deposit acquisitions will increase along with deposit premiums. In fact, in 2016 deposit premiums in branch transactions in the United States increased to 3.54%, up from 2.55% in 2015 according to SNL Financial.

- Capitalize on Opportunities. Be prepared to pursue and capitalize on opportunities based on your deposit portfolio position. For deposit-rich banks, that may mean considering the opportunistic sale of a branch in exchange for an attractive premium. For deposit-deficient banks, it may mean pursuing an acquisition, offering creative deposit products and pricing, or exploring other types of funding options.