Bank Strategy Briefing: 2020-2021 bank M&A round-up and predictions

Bank Strategy Briefing: 2020-2021 bank M&A round-up and predictions

Authored By

Practices

It will come as no surprise that 2020 was an unusual year for bank M&A activity, as the economic effects of the 2019 novel coronavirus (COVID-19) created uncertainty and forced boards and management teams to focus inward. Below are our observations of what happened in 2020 and what to expect in 20211.

2020 M&A trends and highlights

The following trends and highlights characterized M&A activity in 2020:

Deal volume

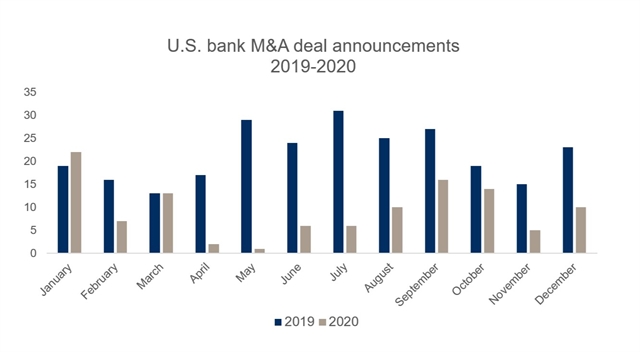

From 2017-2019, bank M&A volume nationally remained remarkably consistent with roughly 250 deal announcements annually. With that context, last year we predicted that 2020 would be a cooling off year given several factors that we witnessed in late 2019, and in fact, that is how 2020 began with the number of announcements early in 2020 Q1 lagging prior years. As COVID-19 hit, M&A activity stopped almost entirely, with just three deal announcements in April and May nationally, before picking up modestly in the summer. The end result was a 56 percent decline in deal announcements nationally2 and a similar 59 percent decline in announcements in our region.3

Factors weighing on M&A

Although many factors played a part, two primary factors weighed on M&A activity. First, the disruption caused by work-from-home issues, Paycheck Protection Program (PPP) implementation, payment deferrals and similar fall-out from COVID-19 necessitated boards and management teams to focus internally. Second, the uncertainty introduced by COVID-19—specifically with respect to the impact on credit quality—made it nearly impossible to value sellers.

Et cetera

For deals that did get inked in 2020, common features included:

- Lower purchase premiums: Median price/TBV ratios of 131.5% versus 158.1% in 2019

- Smaller sellers: Median seller consolidated assets of $125 million versus $216 million in 2019

- Buyer protections: Additional pandemic-related due diligence, representations and conditions in definitive agreements

2021 expectations and predictions

We expect M&A activity in 2021 to outpace 2020. However, many challenging variables lie ahead that will dictate just how robust deal-making will be:

Pent-up demand

There were many deal discussions in early 2020 that were terminated when COVID-19 hit, and certainly other potential sellers that were unable to pursue an attractive transaction. Assuming a relatively stable 2021, M&A activity may come roaring back at some point based on pent-up demand alone.

Taxes, taxes, taxes!

With Democrats controlling the Presidency and Congress, all eyes will be on potential tax legislation. In particular, an increase in capital gains rates could dramatically shift the calculus for potential sellers. Moreover, other types of changes to the tax code could impact estate and tax planning strategies for family-owned institutions, perhaps causing them to sell or hold depending on their unique situation.

“Core” balance sheets and earnings

Pandemic-related economics and stimulus has created a historically complex puzzle of surplus capital and reserves, credit uncertainty, swollen deposit balances and liquidity, rock bottom interest rates, and short-term fee income (PPP and mortgage) for many banks. These factors create challenges for teasing out and valuing a seller’s “core” business and earnings and, therefore, a mutually agreeable purchase price. Such an expectation-gap about pricing between buyers and sellers could prove to be a headwind.

For more information on bank M&A trends, or to learn how our Banking & Financial Institutions Practice Group can help, contact our team.

1 Source for all data: S&P Global Market Intelligence.

2 256 announcements in 2019 versus 113 in 2020.

3 75 announcements in 2019 versus 31 in 2020 for IL, IA, MI, MN, MO and WI.