Bank Strategy Briefing: Community Bank M&A - 2018 year in review and 2019 predictions

Bank Strategy Briefing: Community Bank M&A - 2018 year in review and 2019 predictions

Authored By

Practices

In January 2018, we predicted that nationwide bank M&A activity for the year would decrease after a strong 2017 and that activity in our home state of Wisconsin would increase. How did we do on our predictions?

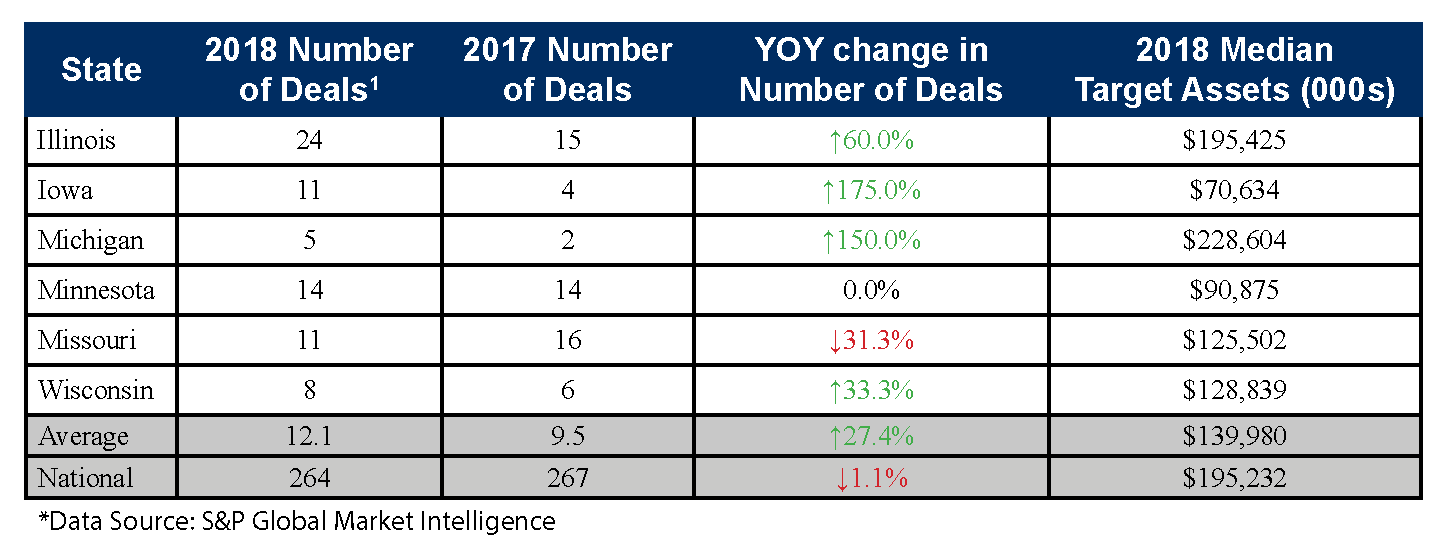

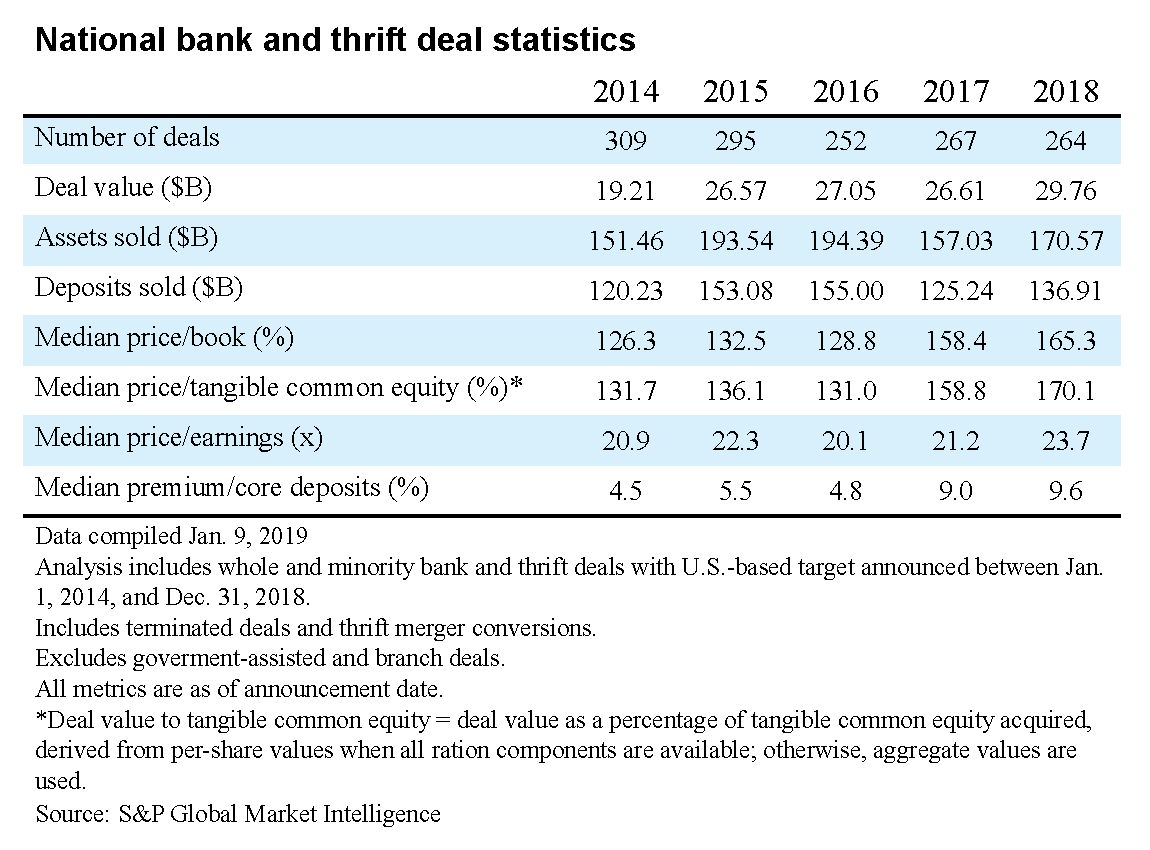

Nationally, bank M&A volume in 2018 remained remarkably flat with 264 announced transactions (compared to 267 in 2017). That said, given that there were fewer banks in 2018 than in 2017, one can argue that M&A activity in 2018 actually increased on a percentage basis. Locally, in Wisconsin and in our Upper Midwest market, our prediction was spot-on. Wisconsin saw 8 whole-bank transactions announced during 2018 (compared to 6 in 2017), and the six states in our Upper Midwest market saw a 28% increase in announced whole-bank transactions (from 57 in 2017 to 73 in 2018).

We believe that this increase in announced deals in 2018 is due to the continuation of several drivers noted in our predictions last year, one of which is increased pricing. Pricing has remained favorable for both buyers and sellers as earnings reflect a growing economy and realization of the full impact of tax cuts implemented under Tax Reform legislation.

For 2019, we see an evolving marketplace for bank M&A. In particular, we think M&A activity in the Upper Midwest—especially in Wisconsin, where there have already been four deal announcements through Jan. 24, 2019—will remain elevated and perhaps may even accelerate further. Here are a couple of new trends to watch:

- Opportunity for Privately-Held Buyers. Many recent active acquirers have been public companies that have been able to pay-up for deals using their “Trump Bumped” stock as merger consideration. With the stock market’s (and their stock price’s) retreat in the latter part of 2018, these public companies are beginning to sit on the sidelines as acquisition opportunities arise because the value of their stock currency has waned. That leaves the door open for privately held buyers to be more competitive acquirers.

- Recession Looming. Many economists are predicting a recession within the next two years, meaning that community banks wishing to sell within the next 2-5 years may be wise to get a deal done now. This may explain in part the high volume of deals recently and could be predictive of a robust M&A market in 2019.

Our Financial Institutions Team at Godfrey & Kahn closely follows local, regional, and national M&A trends. We share this information frequently with clients and friends in the industry. If your board or management team would like more information, please contact any of our attorneys.

1Numbers reflect whole-bank transactions where the seller was headquartered in the state identified.