Bank Strategy Briefing: Midwest bank M&A 2018 predictions

Bank Strategy Briefing: Midwest bank M&A 2018 predictions

Authored By

Practices

In our last edition of Bank Strategy Briefing, we summarized the 2017 bank M&A landscape in Wisconsin and certain other Midwestern states. In this edition, we give our thoughts on what 2018 might yield for community bank M&A.

We believe that 2017 was a year of transition for community bank M&A. More specifically, in addition to the primary M&A deal drivers that have dominated since the Great Recession—e.g., regulatory burden, margin pressure, scale, technology pressures, succession issues, and shareholder liquidity—we have seen new deal drivers emerge that we believe will impact M&A activity in 2018. These evolving deal drivers include:

- Growth Economy. With the economy in full-fledged growth mode, acquirers are emboldened by higher stock valuations and confidence in their own financial stability. Increased earnings also allow for investments in strategic growth initiatives, including the exploration of new markets and acquisition targets as ways to bolster shareholder returns.

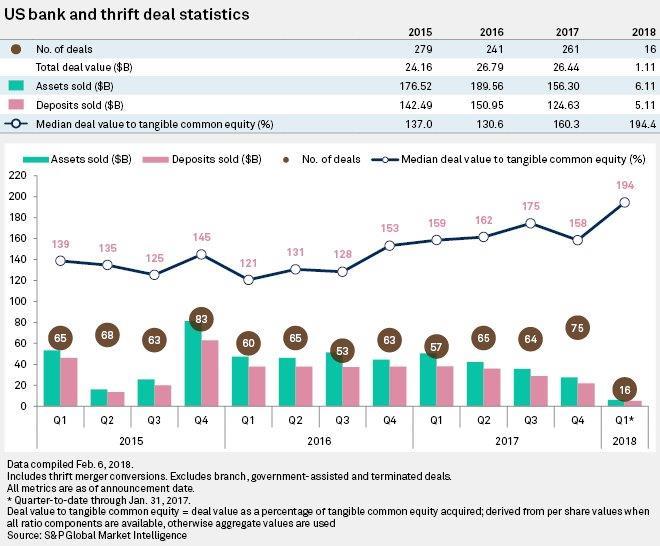

- Pricing. Deal prices measured as a multiple of tangible book value increased significantly in 2017, and it appears this trend will continue in 2018. These increases in tangible book premiums appear to be directly related to increased seller earnings, as evidenced by the fact that price to earnings multiples have remained stable, giving many in the industry comfort that there does not appear to be a “bubble” in deal pricing (at the moment, at least). We believe these trends in deal multiples are evidence that the pricing expectation between buyers and sellers is becoming more harmonious.

- Balance Sheet Matches. Many banks have a need to address balance sheet inefficiencies. As we have written about in previous editions of Bank Strategy Briefing, the need for core deposits is reaching a critical stage at many loan-rich banks. Other banks (often located in rural communities), however, are flush with deposits with tepid loan growth. This should drive community banks in contiguous markets to consider merger opportunities as a way to solve for balance sheet challenges that would be difficult to address organically.

- Certainty, Certainty, Certainty. Perhaps the most important factor influencing community bank M&A activity in 2018 will simply be “certainty.” What remains unclear, however, is exactly what influence it will have. The certainty of tax reform will allow for more definitive strategic planning—especially for family owned banks—making the decision to buy, sell or remain independent less assumption-driven; the certainty of no new bank regulations for the foreseeable future (and perhaps even regulatory relief) will reduce the stress of running a bank; and the certainty of recent modest interest rate increases should drive more favorable earnings and higher bank valuations. While all of these developments could increase buyer and seller interest in M&A, they could all just as easily motivate banks to remain independent.

Ultimately, we believe community bank M&A activity will decline in 2018 nationally as compared to 2017. In our home state of Wisconsin, however, which had six announced whole bank deals in 2017, we predict an uptick in M&A activity in 2018.