Bank Strategy Briefing: Educate your board on subordinated debt markets now

Bank Strategy Briefing: Educate your board on subordinated debt markets now

Authored By

Practices

Over the last year, and in particular since the 2019 novel coronavirus (COVID-19) pandemic arose in March, there has been a significant increase in subordinated debt (sub debt) issuances by bank holding companies. According to S&P Market Intelligence, from May through August of this year there were 66 sub debt issuances totaling $3.9 billion. During the same period in 2019, there were 13 issuances totaling $832.5 million. These numbers are based on publicly available information and likely underreport the total number of sub debt issuances to some degree.

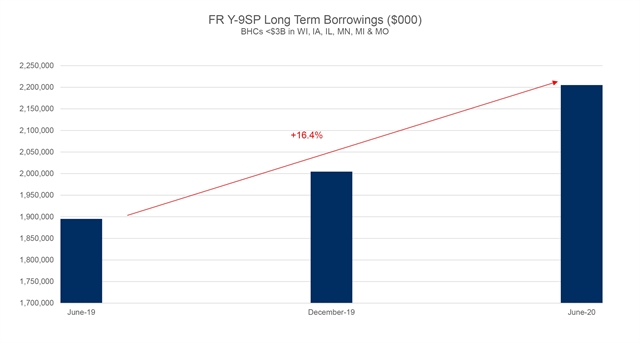

This trend holds true within our local Midwest region as well. As shown in the chart below, long-term borrowings (including sub debt) for bank holding companies with less than $3 billion in consolidated assets increased 16.4 percent from June 30, 2019, to June 30, 2020. We expect that percentage to increase further when year-end FR Y-9SPs are filed.

Three key reasons for increased interest in sub debt

Sub debt, seen as a particularly beneficial capital tool for small bank holding companies under $3 billion in consolidated assets, typically features a 10-year term and generally cannot be called early by the note holder(s). Proceeds are contributed to the subsidiary bank in the form of Tier 1 capital. Sub debt has been around for a long time, so why is there so much interest in today’s environment?

- Protection: The current economic environment is causing boards and management teams to reassess capital plans. If systemic credit deterioration develops, sub debt provides additional capital to absorb losses. Plus, unlike other forms of debt (e.g. bank stock loans), sub debt cannot be cut-off or called early even if the bank’s financial condition begins to suffer.

- Opportunity: If a credit crisis is averted, the additional capital will provide the bank with “dry powder” for organic growth, share buy-backs, market expansion, M&A or other strategic opportunities.

- Favorable terms: There is, of course, a cost to sub debt. However, coupons are at historic lows (generally, 4.0 percent - 6.0 percent), and there is tremendous investor appetite. Moreover, some banks have implemented creative balance sheet strategies to offset the cost of the sub debt, thereby finding a way to make the sub debt pay for itself in whole or in part.

How to issue sub debt

There are several ways to issue sub debt. The simplest and most practical way to issue a large tranche of sub debt is by working with an investment banking firm that can immediately source investors. For smaller issuances, bank holding companies may issue sub debt directly to other banks, or successfully complete friends and family offerings where board members and other accredited investors with ties to the bank are given the opportunity to invest in the sub debt.

It’s time to revisit your capital plan

Given the current economic environment and favorable sub debt markets, boards of directors and executive management teams should revisit their capital plans and, in particular, educate themselves regarding the current state of sub debt markets. While pursuing a sub debt offering will not be appropriate for every bank, the market is favorable now and may become less favorable at any time.