Bank Strategy Briefing: Mergers of three

We have written previously about M&A trends for community banks in the upper Midwest. All of the deals over the last several years have involved the combination of two banks. But did you know that it is possible to merge three (or more) banks together as part of a single transaction?

One does not have to look far to find examples of other financial institutions that have executed three-way mergers. In 2014, Wisconsin based CitizensFirst, Lakeview and Best Advantage credit unions merged to form Verve, a credit union. Then, just this year, 1st Farm Credit Services (IL), Badgerland Financial (WI) and AgStar Financial Services (MN) merged to become Compeer Financial.

A three-way merger of community banks can be a creative solution for small community banks wishing to retain some independence but also looking to address the various strategic challenges causing some community banks to consider a merger or sale such as lack of scale, succession planning, technology costs and balance sheet mix. In particular, a three-way merger can solve for some of the difficulities in effecting a "merger of equals" (MOE).

For example, often community banks cannot find a partner similar enough in size to pitch a truly "equal" MOE partnership. Rather, one bank would clearly be the "acquiring" bank and the other the "acquired." Moreover, very small banks may shy away from MOEs as a realistic option because they may not be capable of realizing the full benefits of enhanced scale even if they combine. (For example, the combination of two $50 million banks likely would not produce the same efficiencies as the combination of two $250 million banks.)

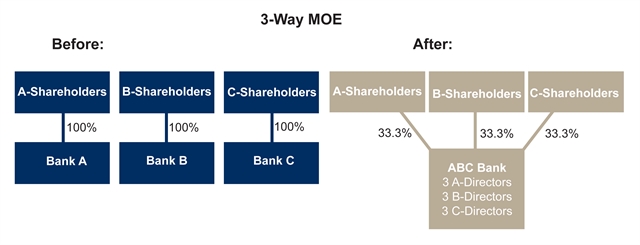

A three-way merger can potentially solve for these MOE challenges and be another option for community banks to pursue. If three similarly sized banks merge in a single transaction, each bank’s shareholders could control approximately 1/3 of the voting power for all matters post-closing (depending on deal valuations). In addition, each bank’s shareholders could receive a separate class of stock with the right to elect their own directors to the resulting board. This way, each group of shareholders has its own local voice in the boardroom, and no single institution’s shareholders retain control. The banks could even continue to have their own brand and local management teams if desired. Plus, significant efficiencies would be more likely even if the merger involves three relatively small institutions.

As with all mergers, many challenges would need to be overcome before a three-way MOE could happen. These challenges include finding three banks interested in combining, determining the makeup of the board and executive management team, and solving for a myriad of other political and cultural issues. However, as evidenced by the recent three-way credit union and farm credit mergers referenced above, these issues are surmountable if discussions involve the right parties with the right motivations.

As your board continues to evaluate your bank’s strategic path, know that there are many options available to you, some of which may not be readily apparent. A three-way merger of community banks is one such option.

This article was reprinted by Wisconsin Banker, available here.