Bank Strategy Briefing: Supporting growth at in-store branches

Bank Strategy Briefing: Supporting growth at in-store branches

Authored By

Practices

Community banks competing for core deposits can consider various channels to attract new customers. In-store branches, while nothing new to the industry and decreasing in number, present a relatively low start-up cost opportunity to reach new retail customers with the potential for deposit growth. These branches, however, also present their own unique risks.

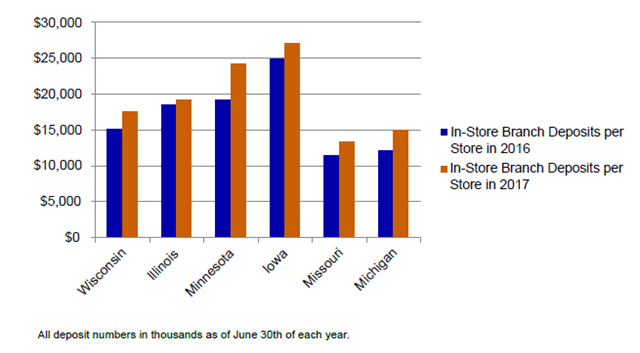

Nationwide, year-over-year deposit growth rates within these branches have exceeded deposit growth within the industry at large. The FDIC’s Summary of Deposits survey reflects year-over-year increases in the average deposits per in-store branch across the Midwest, with branches in Wisconsin averaging $17.6 million in deposits per in-store branch, $19.3 million in Illinois, $24.3 million in Minnesota, $27.1 million in Iowa, $13.6 million in Missouri, and $15.1 million in Michigan as of June 30, 2017.

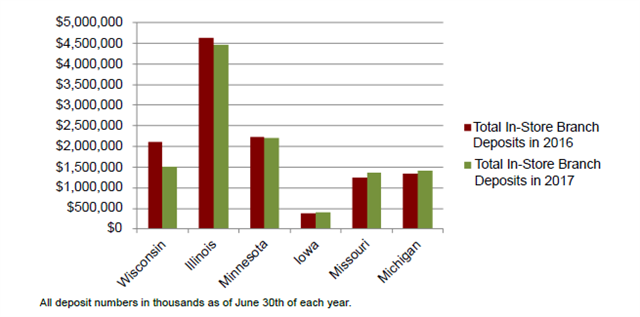

While aggregate in-store branch deposits decreased year over year in Wisconsin, Illinois and Minnesota, much of those decreases were driven by the failure of Guaranty Bank, which maintained a substantial in-store branch network. As of June 30, 2016, these in-store branches held approximately $435 million in deposits in Wisconsin, $26 million in Illinois, and $42 million in Minnesota. Had Guaranty not failed and its deposits remained constant in 2017, then Minnesota would also have experienced an increase in aggregate in-store deposits.

The in-store branch model offers a number of growth-oriented advantages. A bank can market itself directly to customer traffic within the store. Customers themselves often cite the longer operating hours as a service convenience. Traditional branches, on the other hand, depend on cross-selling to existing customers and outside marketing efforts to proactively bring customers through their doors. Additionally, in-store branches might not involve the same investment and commitment as a traditional branch: with smaller space comes lower tenant improvement costs, shorter construction timelines and significantly shorter lease terms.

In-store branches, however, are not without their risks. Leases often specify minimum hours (typically 40 to 50 per week) in which the branch must operate, increasing human resource expense and limiting hour reduction flexibility. Moreover, just as a bank can benefit from the foot traffic in a successful host store, it can also suffer from a struggling one. Stores may close with minimal notice, with affected employees hearing of closures before bank personnel can communicate with them and customers leaving if no other branches are nearby. Furthermore, disputes with host stores may arise over maintenance, such as determining whether the bank or the store is responsible for a given repair or broken utilities or heating and air conditioning impacting branch operations.

For the right bank, in-store branching opportunities may have merit. However, at a minimum, thorough due diligence and thoughtful lease negotiations are critical to increase the chances of realizing the most benefit out of an in-store branch.