Bank Strategy Briefing: 2021-2022 bank M&A round-up and predictions

Bank Strategy Briefing: 2021-2022 bank M&A round-up and predictions

Authored By

Practices

As we pointed out last year, 2020 was an anomalous year for bank M&A activity due to the impacts of the COVID-19 pandemic. Deal activity plunged dramatically both nationally1 and in our region.2 However, we also predicted that 2021 M&A activity would come roaring back based on pent-up demand from 2020 as well as the threat of increased federal capital gains rates promised by Democrats controlling both the White House and Congress. Our predictions turned out to be accurate, and we see plenty of momentum for M&A activity heading into 2022. The following are what we believe to be key highlights from 2021 as well as our expectations for 2022.

2021 M&A trends and highlights

Deal volume

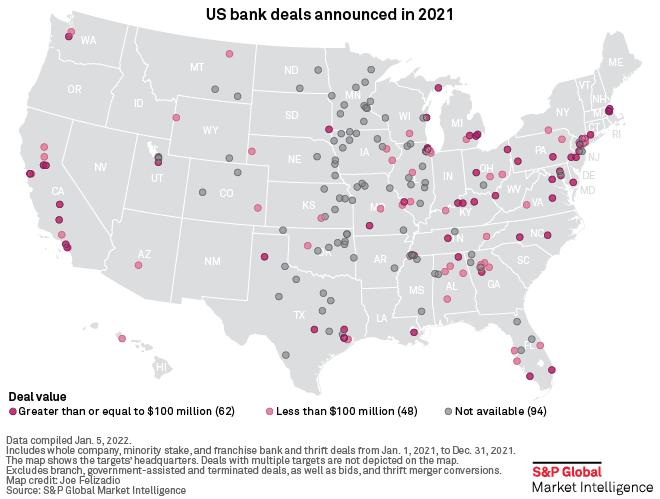

There were 208 whole bank deal announcements in 2021 nationally and 58 in our local region, an increase of 87 percent in each case. When accounting for the relative decline in the number of bank charters over the last several years, 2021 represents close to a full return to pre-COVID levels, with the Midwest leading the way geographically. Put simply, COVID-related concerns had little to no impact on the willingness of buyers and sellers to ink deals.

Deal size

More big bank M&A transactions emerged in 2021, led by Bank of Montreal’s announcement in December that it will pay $16.3 billion to acquire Bank of the West, a $105 billion asset bank headquartered in California. In all, there were 13 announced transactions with deal values exceeding $1.0 billion. Aggregate deal value for the year was $77.6 billion, making 2021 the biggest bank M&A year since at least 2007 based on that metric according to S&P Global.

Pricing

Premiums returned to pre-2020 levels, with publicly announced median Price/TBV and Price/LTM Earnings multiples at 152 percent and 15x, respectively, on a national level, and 161 percent and 16x in our local region.

2022 expectations and predictions

Our banking industry attorneys expect bank M&A activity in 2022 to remain at levels similar to those seen in 2021. Although interest rate hikes that could alleviate some level of margin compression appear to be on the horizon, earnings outlooks for the foreseeable future still appear to be modest for many community banks as PPP fee recognition and mortgage refinance income slows. This will inevitably lead to additional sellers in the marketplace when combined with other well-established sale motivators such as succession challenges, the pace of technology and compliance, and desires for liquidity, to name a few.

Buyers with a long-term vision to remain independent will pay-up for scale and the opportunity to enter new or further penetrate existing markets, especially those markets with loan growth potential. In many cases, the ability to “win” a deal by paying the most attractive premium will rest largely on the ability to profitably deploy excess funding obtained from deposit-rich targets.

For more information on bank M&A trends, or to learn how Godfrey & Kahn can help, contact a member of our Banking & Financial Institution Practice Group.

1 111 whole bank announcements in 2020 versus 255 in 2019.

2 31 whole bank announcements in 2020 versus 75 in 2019 for our local region of IL, IA, MI, MN, MO, and WI.