How Biden’s American Rescue Plan impacts employee leave

How Biden’s American Rescue Plan impacts employee leave

Authored By

Practices

On March 11, 2021, President Joe Biden signed the American Rescue Plan Act of 2021 (the American Rescue Plan). In addition to providing various stimulus benefits due to the ongoing 2019 novel coronavirus (COVID-19) pandemic, the American Rescue Plan expands the qualifying reasons for employee leave and the tax credits available to employers for providing paid leave to employees under the Families First Coronavirus Response Act (FFCRA). Notably, the American Rescue Plan does not require employers to provide paid leave. Leave provisions within the requirements of the FFCRA are strictly voluntary with the benefit of tax credits if leave is provided.

FFCRA refresher

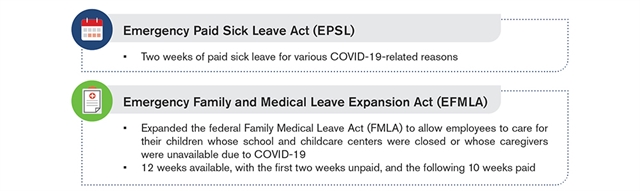

As a reminder, the FFCRA first took effect on April 1, 2020, and included two paid leave mandates for employers with less than 500 employees:

The American Rescue Plan

Shortly before the FFCRA expired on Dec. 31, 2020, then President Donald Trump signed the Consolidated Appropriations Act of 2021 (Consolidated Appropriations Act) into law, providing employers the option to continue offering FFCRA leave in exchange for a tax credit for qualified wages paid to employees through March 31, 2021.

The American Rescue Plan similarly does not require employers to provide paid leave but expands the prior tax credit period from March 31, 2021, to Sept. 30, 2021. Unlike the Consolidated Appropriations Act, however, the American Rescue Plan also expands the qualifying reasons for leave under the EPSL and EFMLA as well as the amount of available tax credits.

Based on how the U.S. Department of Labor (DOL) has responded to the publication of revisions to the FFCRA in the past, it is likely the DOL will publish clarifying guidance in the form of a Frequently Asked Questions (FAQ) document in the near future. Until that time, it is important for employers to understand the impacts the American Rescue Plan will have on EPSL, EFMLA and non-discrimination provisions.

Emergency Paid Sick Leave

The American Rescue Plan expands the qualifying reasons for EPSL and resets the balance of EPSL that employers can voluntarily provide to eligible employees to two weeks as of April 1, 2021. In other words, if an employee has exhausted the original two weeks before April 1, 2021, employers have the option to provide such employee an additional two weeks of EPSL for use between April 1, 2021, and Sept. 30, 2021.

Notably, employees who have not exhausted the original two weeks of EPSL by April 1, 2021, will not carry over such leave. For example, an employee who utilized one week of EPSL in 2020 will not have three weeks of ESPL available after April 1, 2021.

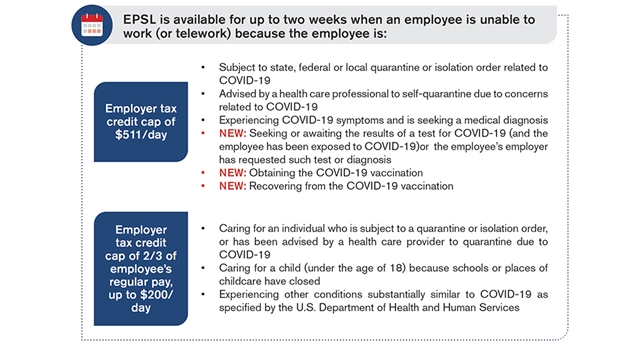

The qualifying reasons for using EPSL include the six original reasons and three new reasons. The available tax credit to employers for the paid leave that is provided is based on the reason for the employee’s leave, as noted below.

Emergency Family and Medical Leave Expansion Act

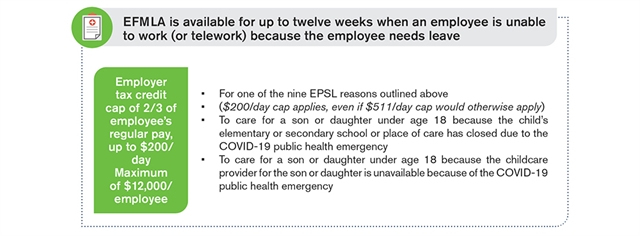

The American Rescue Plan expands the qualifying reasons for EFMLA to include the original EFMLA qualifying reasons (e.g., care for a child due to a school closure) and for all of the above EPSL qualifying reasons. It also removes the provision that the first two weeks of EFMLA are unpaid. Therefore, employers may now voluntarily provide up to 12 weeks of paid EFMLA leave in exchange for a tax credit.

This means that employees who may have previously exhausted their 10-week EFMLA entitlement may be provided an additional two weeks of leave at their employer’s discretion.

As a reminder, while the qualifying reasons for leave are now similar under the EPSL and EFMLA, if an employee is provided EPSL, that is a separate benefit and does not reduce the amount of leave provided under the EFMLA. Accordingly, it is possible for an employee to take up to 14 weeks of paid leave, and for the employer to receive the corresponding tax credit, if an employer elects to extend the EPSL and EFMLA benefits after April 1, 2021.

Non-discrimination provisions

Finally, the American Rescue Plan cautions that employers may not discriminate against highly compensated employees, full-time employees or employees on the basis of tenure when making the decision to provide leave. Failure to comply with such requirements will result in ineligibly for the tax credits.