Bank Strategy Briefing: New Wisconsin Tax Law Could Benefit S Corporation Banks

Bank Strategy Briefing: New Wisconsin Tax Law Could Benefit S Corporation Banks

Authored By

Practices

Wisconsin recently enacted legislation that allows pass-through entities — including S corporation banks — to be taxed at the corporate level rather than at the shareholder level for Wisconsin tax purposes. The benefit of the election is to permit shareholders of S corporations to effectively circumvent the new $10,000 federal limitation on deducting state and local taxes, including state income taxes paid by shareholders on their share of the S corporation’s income.

If the election is made, the corporate-level tax would be deductible by the bank for federal income tax purposes and reduce the amount of federal taxable income passing through to the bank’s shareholders on their Schedule K-1s. There is some uncertainty regarding the effectiveness of this election since the IRS has recently indicated that it may challenge the deductibility of similar entity-level tax regimes created by other states in response to the state and local tax deduction limitation. The legislation that contains this new election is also currently being challenged in Wisconsin courts on procedural grounds based on how the legislation was passed during a special legislative session.

The election can be made effective beginning in the 2018 tax year for S corporations. The election must be made on or before the due date (including extended due date) of the corporation’s tax return.

If an election is made, the bank will be taxed at the flat C corporation income tax rate of 7.9%, which is higher than the maximum 7.65% tax rate that otherwise applies to individual and trust shareholders of the bank. Importantly, no tax credits are allowed to a corporation making the election other than the credit for taxes paid to other states. If the corporation would otherwise qualify for other types of credits, an election may not be advisable. The election may be made or revoked each year with consent of a majority of the bank’s shareholders.

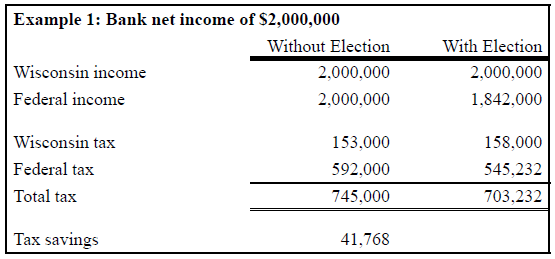

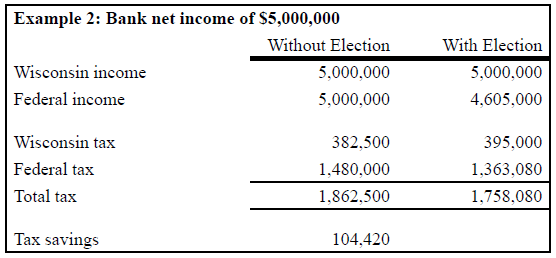

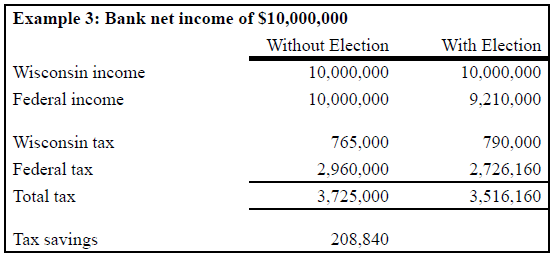

To illustrate the potential benefits of the election, assume that a Wisconsin bank taxed as an S corporation operates entirely within Wisconsin and that all of its shareholders are Wisconsin residents subject to maximum tax rates. The shareholders are able to claim the 20% federal qualified business income deduction on the bank’s income, resulting in a federal tax rate of 29.6%. The shareholders have also reached the $10,000 limitation on deducting state and local taxes from other taxes paid by the shareholders. The following charts detail the potential savings of making the election, assuming that the bank does not qualify for any Wisconsin tax credits.

As these examples show, given the right set of circumstances, this election may be worth considering for many Wisconsin banks that are taxed as S corporations. Banks considering this election should work with their accountants to model the potential tax savings and ensure that proper estimated tax payments are being made.

Bank Strategy Briefing is prepared by the Banking & Financial Institutions Practice Group at Godfrey & Kahn, S.C., Milwaukee, Wisconsin, as a service to the community banking industry. It features commentary focusing on strategic business and legal issues relevant to community banks. Each written edition contains 500 words or less and no more than 2 editions are published per month. Information found in Bank Strategy Briefing is for educational and informational purposes only and is not to be construed or relied upon as legal advice.