SEC Adopts Pay Versus Performance Disclosure Requirements

SEC Adopts Pay Versus Performance Disclosure Requirements

Authored By

Practices

The Securities and Exchange Commission (SEC) recently adopted new pay versus performance disclosure requirements, which will require companies to disclose information reflecting the relationship between executive compensation actually paid by a company and the company’s financial performance. The new rules will require companies to provide a table and clear descriptions disclosing specified executive compensation and financial performance measures for their five most recently completed fiscal years, among other items.

Subject to certain exceptions, companies must begin to comply with the new disclosure requirements in proxy and information statements that are required to include executive compensation disclosure for fiscal years ending on or after December 16, 2022. Therefore, calendar year-end companies will need to include the new disclosures in the proxy statements filed during the 2023 proxy season. Smaller reporting companies (SRCs) will be subject to scaled disclosure requirements under the new rules.

New Item 402(v) of Regulation S-K

The new rules adopted by the SEC add Item 402(v) of Regulation S-K, which requires companies to describe the relationship between the executive compensation actually paid by the company and the financial performance of the company over the time horizon of the disclosure.

Form of Disclosure

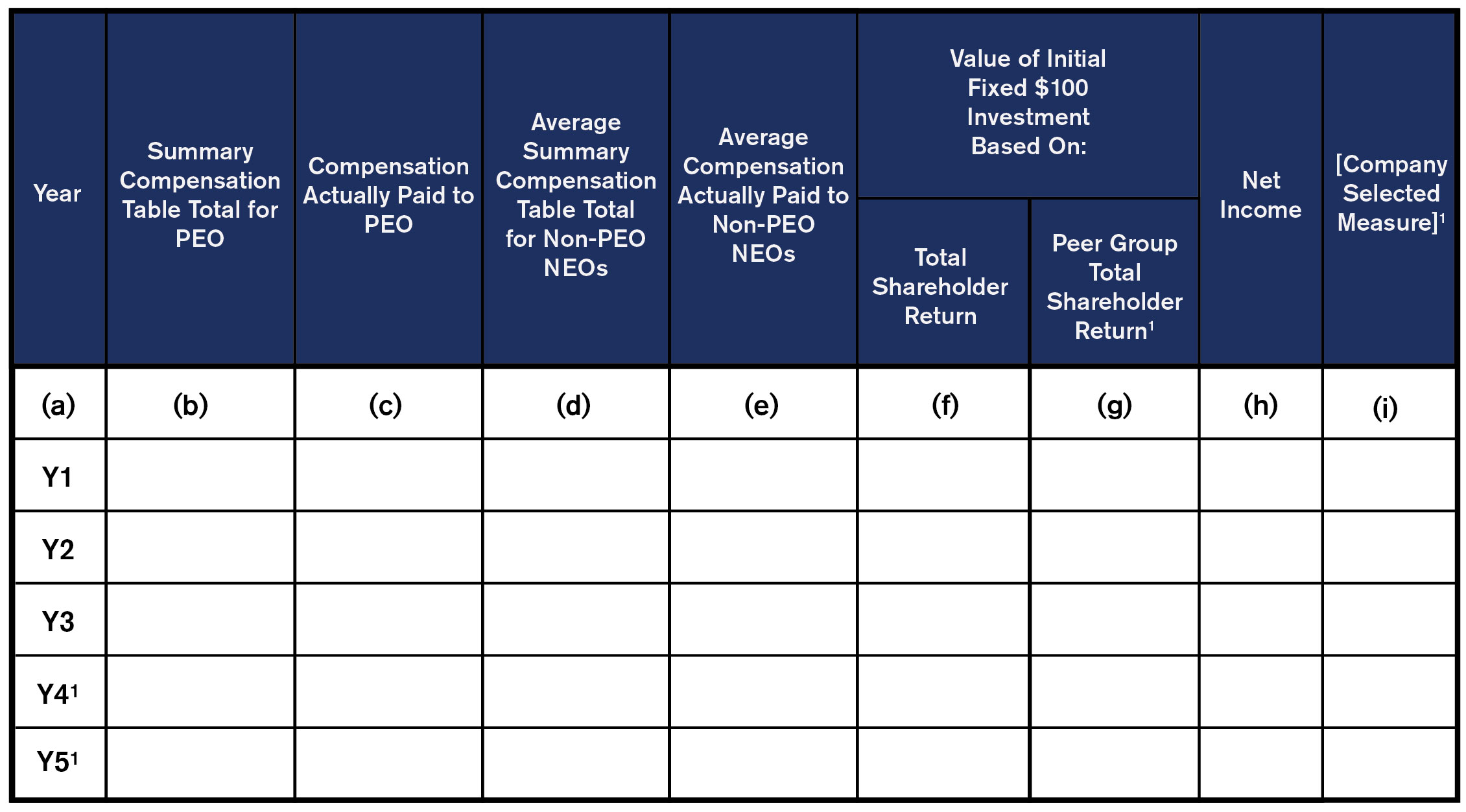

In a table similar to the below, companies will be required to include, for the principal executive officer (PEO) and, as an average, for the other named executive officers (NEOs), the Summary Compensation Table measure of total compensation and a measure reflecting “executive compensation actually paid,” calculated as prescribed by the rule.

The following financial performance measures will also be required in the table:

- cumulative Total Shareholder Return (TSR) of the company;

- the TSR of the company’s peer group;

- the company’s net income; and

- a financial measure chosen by the company and specific to the company (Company-Selected Measure).

1 Not required for SRCs.

Narrative and/or Graphic Description

In addition, companies are required to use the information in the above table to provide clear descriptions of the relationships between compensation actually paid and three measures of financial performance, as follows: describe the relationship between (a) the compensation actually paid to the company’s PEO and (b) the average compensation actually paid to the company’s remaining NEOs to (i) the cumulative TSR of the company, (ii) the net income of the company, and (iii) the company’s Company-Selected Measure, in each case over the company’s five most recently completed fiscal years.

Companies are also required to provide a clear description of the relationship between the company’s TSR and the TSR of a peer group chosen by the company, also over the company’s five most recently completed fiscal years.

Companies have flexibility as to the format in which to present the descriptions of these relationships, whether graphical, narrative, or a combination of the two. Companies will also have the flexibility to decide whether to group any of these relationship disclosures together when presenting this disclosure, but any combined description of multiple relationships must be “clear.”

Executive Compensation Actually Paid

“Executive compensation actually paid” means the total compensation for the covered fiscal year for each NEO with the following general adjustments:

- minus the aggregate change in the actuarial present value of the NEO’s accumulated benefit under all defined benefit and actuarial pension plans reported in the Summary Compensation Table;

- plus, for all defined benefit and actuarial pension plans reported in the Summary Compensation Table, the aggregate of (x) actuarially determined service cost for services rendered by the executive during the applicable year (Service Cost) and (y) the entire cost of benefits granted in a plan amendment (or initiation) during the covered fiscal year that are attributed by the benefit formula to services rendered in periods prior to the plan amendment or initiation (Prior Service Cost);

- minus the aggregate grant-date fair value of any stock and option awards granted during the year;

- plus (i) the year-end fair value of any awards granted in the covered fiscal year that are outstanding and unvested as of the end of the covered fiscal year; (ii) the amount of change as of the end of the covered fiscal year (from the end of the prior fiscal year) in fair value of any awards granted in prior years that are outstanding and unvested as of the end of the covered fiscal year; (iii) for awards that are granted and vest in the same covered fiscal year, the fair value as of the vesting date; and (iv) for awards granted in prior years that vest in the covered fiscal year, the amount equal to the change as of the vesting date (from the end of the prior fiscal year) in fair value;

- minus, for awards granted in prior years that are determined to fail to meet the applicable vesting conditions during the covered fiscal year, the amount equal to the fair value at the end of the prior fiscal year; and

- plus the dollar value of any dividends or other earnings paid on stock or option awards in the covered fiscal year prior to the vesting date that are not otherwise reflected in the fair value of such award or included in any other component of total compensation for the covered fiscal year.

Company Cumulative TSR and Peer Group TSR

Under the adopted rules, all companies subject to the final rules must use TSR and all companies (other than SRCs) must use peer group TSR as measures of performance. Companies must also provide a narrative, graphical, or combined narrative and graphical description of the relationships between executive compensation actually paid and the company's TSR, and between the company’s TSR and the peer group TSR.

The final rules require a company to disclose weighted peer group TSR using either the same peer group used for purposes of Item 201(e) of Regulation S-K or a peer group used in the compensation discussion and analysis (CD&A) for purposes of disclosing companies’ compensation benchmarking practices. If the peer group is not a published industry or line-of-business index, the identity of the issuers composing the group must be disclosed. If the company selects or otherwise uses a different peer group from the peer group used by it for the immediately preceding fiscal year, it must explain the reason(s) for this change and compare the company’s cumulative total return with that of both the newly selected peer group and the peer group used in the immediately preceding fiscal year.

Company-Selected Measure

As noted above, the table must include a Company-Selected Measure. A Company-Selected Measure is that measure, which, in the company’s assessment, represents the most important financial performance measure (that is not otherwise required to be disclosed in the table) used by the company to link compensation actually paid to the company’s NEOs, for the most recently completed fiscal year, to company performance. The rules describe “financial performance measure” as measures that are determined and presented in accordance with the accounting principles used in preparing the issuer’s financial statements, any measures that are derived wholly or in part from such measures, and stock price and total shareholder return. A financial performance measure does not need to be presented within the company’s financial statements or otherwise included in a filing with the SEC to be a Company-Selected Measure.

Tabular List of Important Financial Measures

A company (other than an SRC) must also provide an unranked list of three to seven financial performance measures that are the most important measures used by the company to link executive compensation actually paid during the fiscal year to company performance (Tabular List). The company will determine the financial performance measures by using the same approach taken to select the Company-Selected Measure. Companies are permitted, but not required, to include non-financial measures in the Tabular List if they considered such measures to be among their three to seven “most important” measures.

The company may provide the Tabular List disclosure either as one tabular list, as two separate tabular lists (one for the PEO, and one for all NEOs other than the PEO), or as separate tabular lists for the PEO and each NEO other than the PEO.

Supplemental Disclosures

Companies are permitted to disclose additional pay-versus-performance information beyond the required disclosure, so long as it would not be misleading or obscure the required information. Any supplemental measures of compensation or financial performance and other supplemental disclosures provided by companies must be clearly identified as supplemental, not misleading, and not presented with greater prominence than the required disclosure.

Inline XBRL

Companies (other than SRCs) will be required to use Inline XBRL to tag their pay versus performance disclosure starting with the first year.

Smaller Reporting Companies:

Consistent with existing scaled executive compensation disclosure requirements, the following scaled disclosures will be available to SRCs under the new requirements:

- May provide three, instead of five, fiscal years of disclosure;

- Not required to disclose amounts related to pensions for purposes of disclosing executive compensation actually paid;

- Not required to present peer group TSR;

- Permitted to provide two years of data, instead of three, in the first applicable filing after the rules became effective; and

- Not required to provide disclosure in the prescribed table in XBRL format until the third filing in which it provides pay-versus-performance disclosure, instead of the first like other companies.

Filings and Timing of Disclosure

As noted above, companies must begin to comply with these disclosure requirements in proxy and information statements that are required to include executive compensation disclosure for fiscal years ending on or after December 16, 2022.

Companies (other than SRCs) will be required to provide the information for three years in the first proxy or information statement in which they provide the disclosure, adding another year of disclosure in each of the two subsequent annual proxy filings that require this disclosure.

SRCs will initially be required to provide the information for two years, adding an additional year of disclosure in the subsequent annual proxy or information statement that requires this disclosure.

Key Considerations

Calendar year-end companies will need to include the new disclosures in their proxy statements for their 2023 annual shareholder meetings. We expect that complying with Item 402(v) of Regulation S-K will require extensive calculations and new disclosure drafting. Except for SRCs, calendar-year end companies will need to provide disclosures that cover fiscal years 2022, 2021 and 2020, so we advise companies to start preparing disclosures for the prior years, as the necessary information is already available. Companies should also begin considering what financial performance measure they would like to select as the Company-Selected Measure and what other financial performance measures should be considered for the Tabular List. Given the significance of the shift represented by the new rules from traditional compensation disclosures to disclosures of realized compensation relative to TSR, we advise companies to communicate early with their compensation committee and board of directors regarding the nature and potential impact of the new requirements, including presenting draft disclosures and discussing the potential effect on future say-on-pay proposals. We will be happy to answer any questions you may have on the disclosures and to assist as you begin to consider how best to implement and comply with the new requirements.